NEWS & EVENTS

NEWS & EVENTS

Announcement No. 8 of 2021 of the General Administration of Customs (Announcement on the trigger level of imports of two types of agricultural products from Australia in 2021)

NEWS 2021.01.28

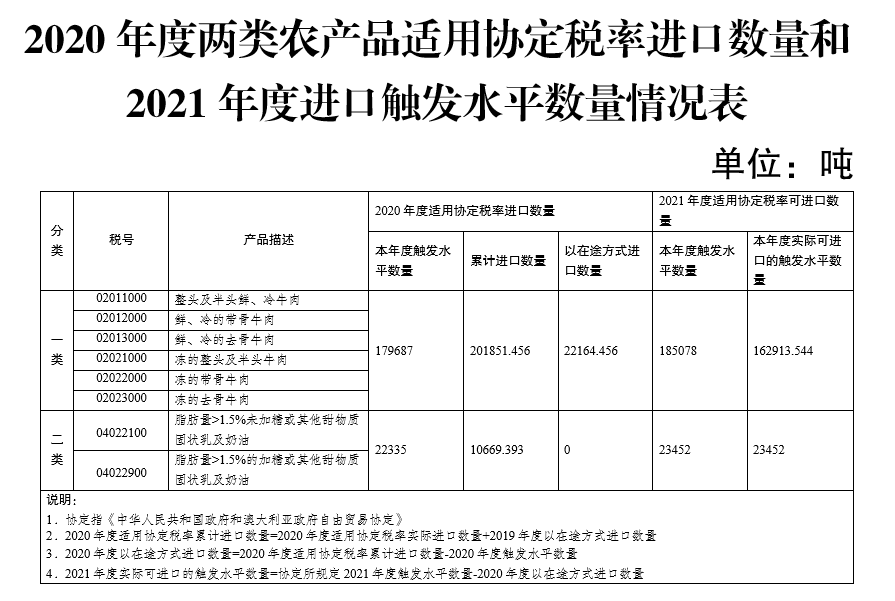

According to the "Free Trade Agreement between the Government of the People's Republic of China and the Australian Government" and the General Administration of Customs Announcement No. 207 of 2019, my country has implemented special safeguard measures for two types of agricultural products imported from Australia with eight tax codes (hereinafter referred to as the two types of agricultural products). The import volume of the two types of agricultural products applicable to the agreement tariff rate in 2020 and the import trigger level volume in 2021 are now announced (see the attachment for details).

When importing the two types of agricultural products, the relevant procedures shall still be handled in accordance with the provisions below.

In order to facilitate the implementation of special safeguard measures for agricultural products under the Free Trade Agreement between the Government of the People's Republic of China and the Government of New Zealand and the Free Trade Agreement between the Government of the People's Republic of China and the Australian Government, the General Administration of Customs has decided to further optimize related management procedures. The relevant matters are announced as follows:

1. The "relevant agricultural products" mentioned in this announcement refer to agricultural products originating in New Zealand subject to special safeguard measures, including 4 categories, with a total of 12 tariff numbers; those originating in Australia subject to special safeguard measures Of agricultural products, including 2 categories, a total of 8 tariff numbers. The so-called "agricultural products in transit" refer to the relevant agricultural products that have been contracted before the implementation of the special safeguard measures and have been shipped to China.

2. When the consignee or agent of imported goods (hereinafter referred to as the "importer") declares to the customs for the import of relevant agricultural products, it shall make a declaration in accordance with the customs declaration form under the preferential trade agreement after the means of transport declares entry.

When the amount of agricultural products applicable to the treaty tariff rate exceeds the trigger level, the customs releases relevant information on the "Single Window", "Internet +" platform and "Handheld Customs" APP. Except for the agricultural products in transit for which the agreed tariff rate is applicable, the amount exceeds The most-favored-nation tax rate applies to imported agricultural products.

3. For agricultural products in transit that are declared for import after the implementation of special safeguard measures, the importer can log in through the "Single Window", "Internet +" platform or "Handheld Customs" APP to log in "The tariff rate of imported agricultural products in transit applies after the goods actually arrive at the port." Enter the relevant information in the certification application system, apply to the customs for the "Certificate of Application of Imported Agricultural Products Tariff Rates" (hereinafter referred to as "Certificate of Transit"), and submit the following documents:

(1) Valid evidence of origin;

(2) Invoice, packing list, contract;

(3) Relevant documents that can prove the time of shipment and arrival time of the means of transport.

4. The customs shall, within 5 working days after receiving the importer's application, issue the "in-transit certificate" for the agricultural products in transit to which the treaty tax rate is applicable, in the order of receipt of the valid application.

5. The import quantity of agricultural products in transit for which the treaty tax rate is applied in the current year will be included in the import quantity of relevant agricultural products for the applicable treaty tax rate in the next year. When the accumulated amount reaches the trigger level of the next year, the customs will no longer issue the "in transit certificate".

6. When the importer declares the in-transit agricultural products to which the agreed tax rate is applicable, he should fill in "997" in the "exemption nature" column of the customs declaration form, fill in the "special case" in the "levy exemption" column, and fill in the origin evidence document number and "in the remarks column" "Certificate of Transit" number. After customs review and approval, the tax shall be calculated and levied by manually entering the agreed tax rate according to the "special case" method.

"Certificate in transit" should be used within the validity period of the corresponding proof of origin.

Source: General Administration of Customs

The import, export and production of 8 types of mercury-added products will be banned from 2026!

2024.12.09

Announcement on Adjusting the list of Imported Foods subject to the Administration of Examination and Approval of Entry Plant and Animal Quarantine

2024.12.09

Tariff list of entry articles of the People's Republic of China

2024.12.05

General Administration of Customs Announcement No. 66 of 2023 (Catalogue of Import and Export Licenses for Dual-Use Items and Technologies)

2024.07.22

Decree of The State Council of the People's Republic of China No. 785 (Regulations on the Management of Rare Earth)

2024.07.02

General Administration of Customs Announcement No. 76 of 2024 (Announcement on Inspection and Quarantine Requirements for Imported Polish Beans)

2024.07.02

General Administration of Customs Announcement No. 75 of 2024 (Announcement on the Inspection and Quarantine Requirements of Brazilian Pecan Fruit exported to China)

2024.07.02

General Administration of Customs Announcement No. 73 of 2024 (Announcement on Phytosanitary Requirements for the Import of Fresh Kiwifruit from New Zealand)

2024.07.02

General Administration of Customs Announcement No. 72 of 2024 (Announcement on Phytosanitary Requirements for the Import of Fresh Durian from Malaysia)

2024.07.02

Starting from May 1st, my country will adjust tariffs on some steel products

2024.06.07

Please enter keyword search