SERVICE

SERVICE

Lamps import document process and precautions

NEWS 2024.06.04

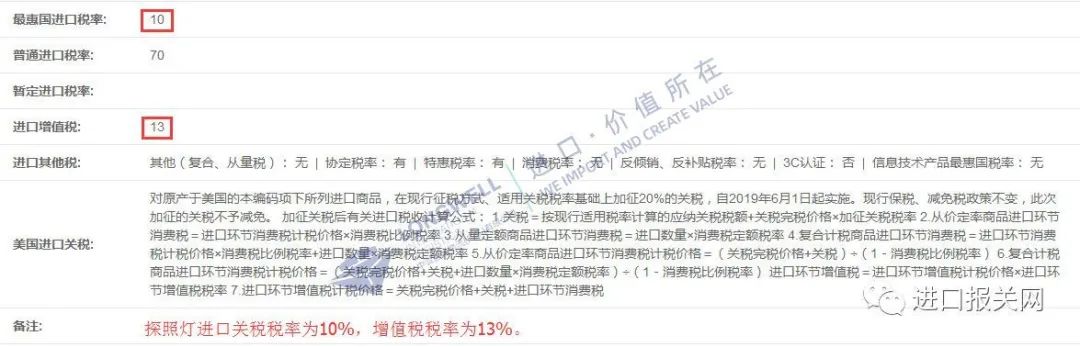

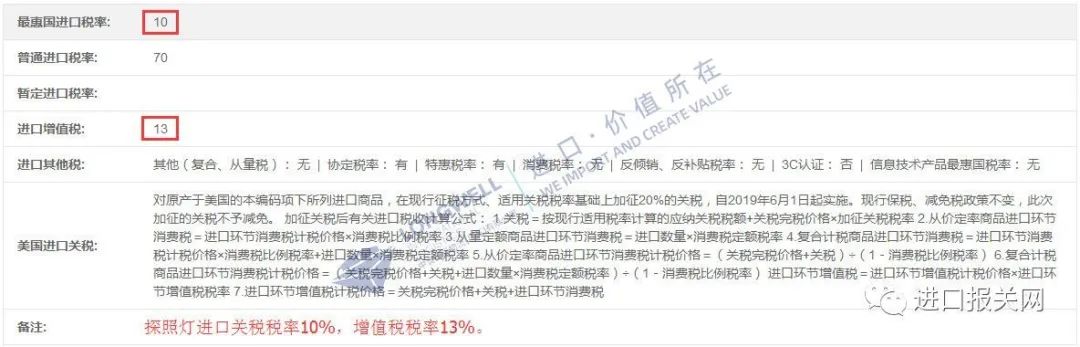

Lamps import tax rate and declaration precautions:

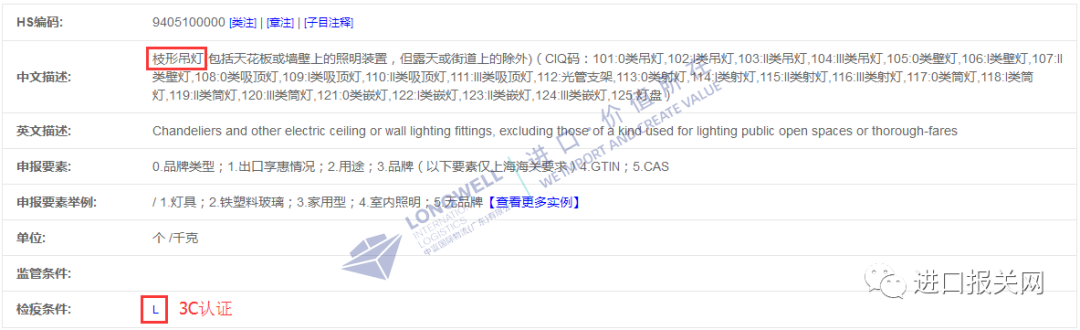

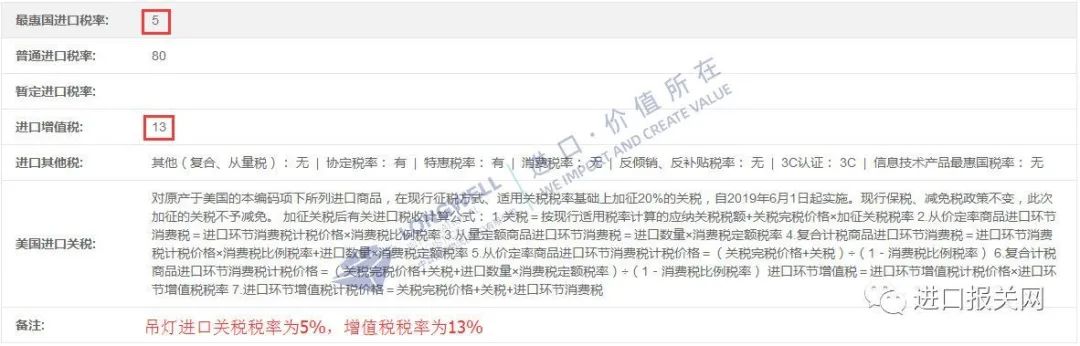

The import tariff rate for chandeliers and wall lamps is 5%, and the VAT rate is 13%.

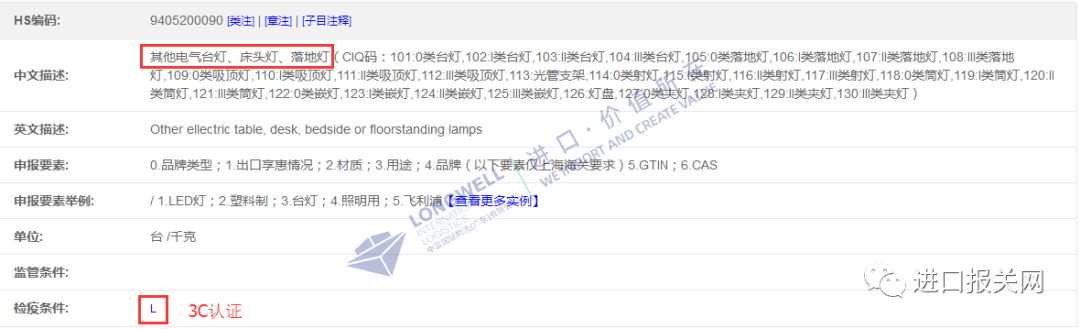

Table lamps, bedside lamps, floor lamps import duty rate of 10%, VAT rate of 13%.

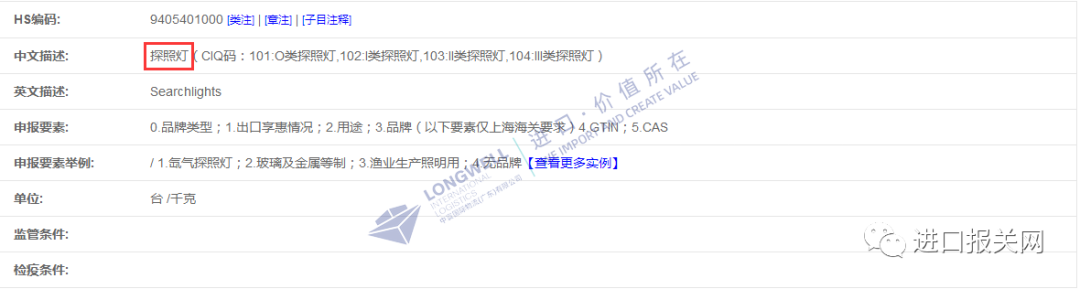

The searchlight import duty rate is 10% and the VAT rate is 13%.

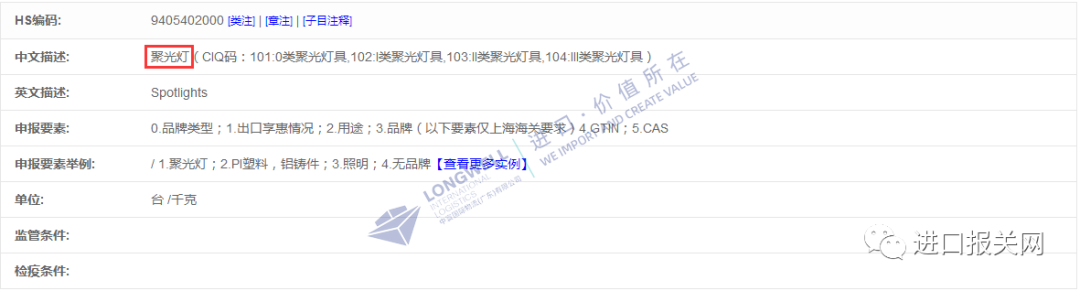

The spotlight import duty rate is 10% and the VAT rate is 13%.

Documents required for imported lamps:

Basic documents: packing list, invoice, contract, Bill of lading

Special documents: 3C certification, or 3C exemption

Note: Regarding the declaration elements of imported lamps such as chandeliers and table lamps, Guangdong Customs requires the number of lamp holders to be declared, while Shanghai Customs does not need to declare the number of lamp holders. (In the actual lighting import declaration operation process, the requirements of different customs areas are different, so import enterprises should understand the local situation in advance and choose a professional import declaration company)

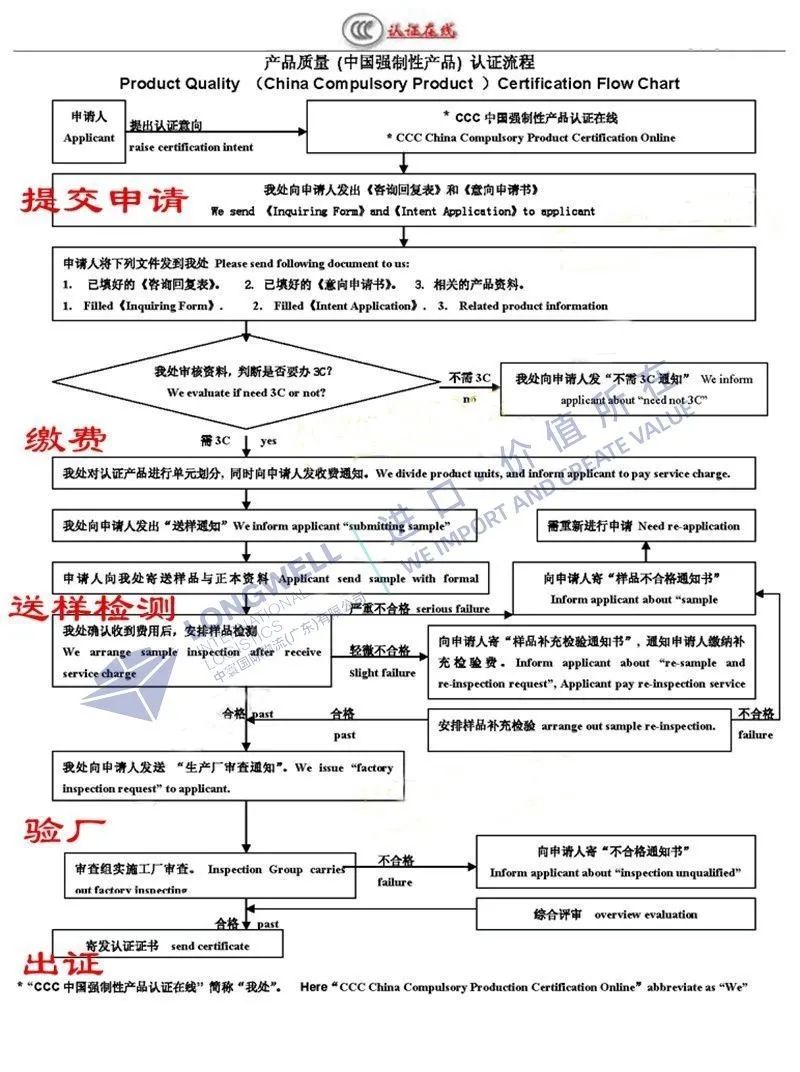

3C certification process for imported lamps:

Note: there are several difficulties in handling imported lamps, the first is the long certification time cycle, the second is the high cost of certification (at least tens of thousands of dollars for a 3c certification), the third foreign manufacturers for reasons such as trade secrets (to put it plainly, it is afraid of being copied by Chinese manufacturers), rarely accept factory inspection. Therefore, most Italian handicraft lamps are difficult to provide 3C certification when imported.

Please enter keyword search