SERVICE

SERVICE

Return import declaration

NEWS 2021.03.05

1. What documents are required for customs declaration for the return of exported goods?

As the world's largest trading country, China exports a large amount of goods to all parts of the world every year. At the same time, it also needs to be returned due to lack of payment, quality problems, or lack of import documents abroad. After the returned goods arrive at the port, they need to go through relevant import declaration procedures.

According to the import declaration of returned goods, the following conditions must be met at the same time:

First, the export has not exceeded one year;

Second, it can provide a full set of original export declaration documents and materials;

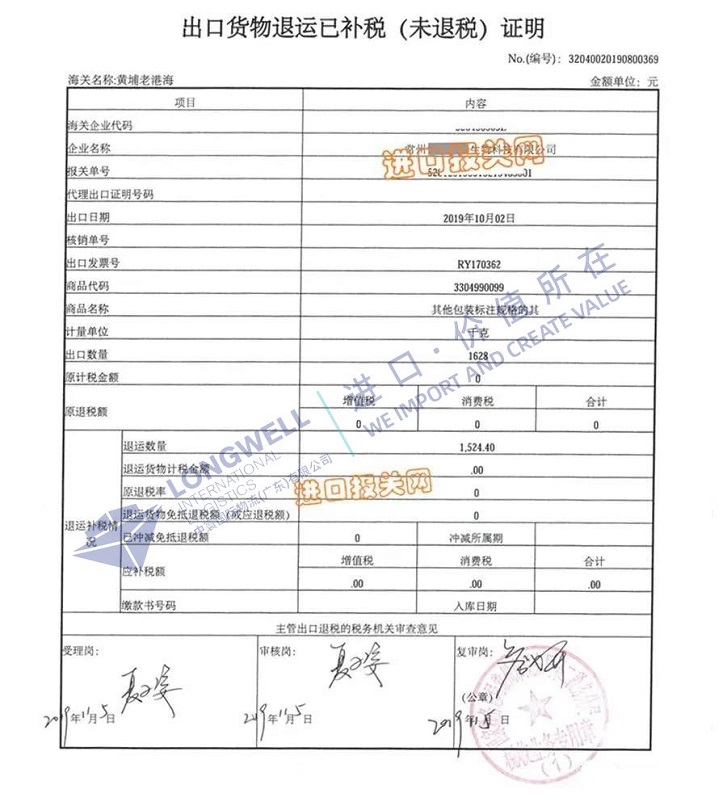

Third, can provide proof of tax reimbursement or non-refund.

2. Several common reasons for the return of exported goods

1. The quality is unqualified, and both parties have reached a written return agreement;

2. The model of the goods is inconsistent with the provisions of the purchase contract, and the two parties have reached a written return agreement;

3. Goods returned due to overloading or missing unloading caused by wrong delivery or wrong shipment;

4. Goods ordered by the customs to be returned in accordance with national regulations.

In addition, after the goods arrive at the port, the buyer cannot be contacted; or the domestic exporter has a trade dispute with the foreign buyer, and the exporter may not receive the payment and the return will occur.

3. The operation process of import customs declaration for the return of exported goods

Arrange for overseas shipping to return to the designated domestic terminal → After the goods arrive at the port, the shipping company will make a bill and settle the shipping company's port of destination expenses (THC/DOC, etc.) → apply for a third-party intermediate inspection appraisal report (payment first, then certificate) → After the certificate is issued, declare the return import declaration (without paying import tariffs and value-added tax) → inspection, release → terminal order and settlement of terminal expenses.

4. Documents and materials required for import declaration for the return of exported goods

1: Packing list

2: Invoice

3: Contract

4: Return shipping agreement

5: Return information sheet

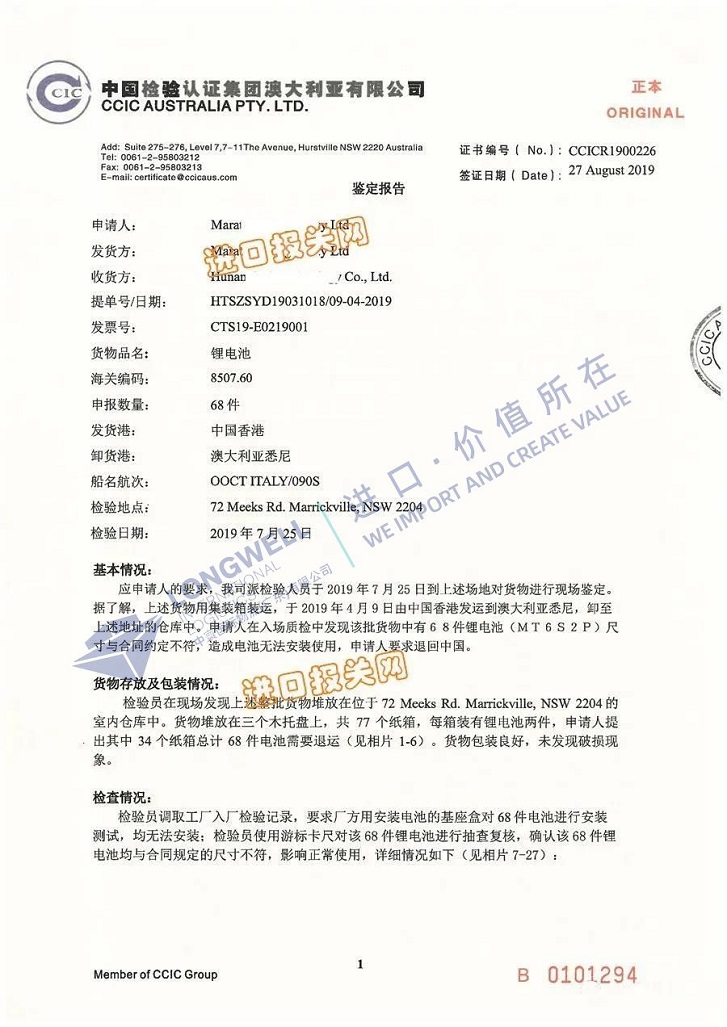

6: Third-party intermediate inspection appraisal report

7: A full set of original export declaration documents

8: Certificate of non-refund or tax reimbursement

9: Other relevant documents required by the customs

5. Interim inspection appraisal report on returned goods

When applying for the inspection certificate, you need to provide samples or let the inspection company send staff to the site for inspection. If the inspection results are consistent with the application, the relevant quality problem identification certificate will be issued. Administrative charge: RMB1500-2500/variety.

Remarks: The inspection certificate can be processed abroad (originally importing country or region), it can also be processed during transit in Hong Kong, or after the goods arrive at the domestic terminal.

6. About "Proof of Non-Refund of Taxes" & "Certificate of Tax Compensation"

To apply for the "Certificate of Non-Refundable Tax" from the competent tax authority, an enterprise generally needs to submit the following information:

1. The original and photocopy of the export goods declaration form (for export tax rebate) (for loss, you need to explain the situation with the competent tax authority); 2. The copy and photocopy of the agency export agreement (contract) (the export agency needs to submit); 3. "Application Form for Certificate of Non-Export Tax Rebate"; 4. Other materials required by national tax. To apply for the "Tax Compensation Certificate", first go to the tax bureau to obtain a triplicate "Export Commodity Returned Tax Compensation Certificate", and then make the "Tax Compensation Certificate" electronic data in the tax refund declaration system, and then print it out. Prepare the original and photocopy of the customs form, verification form, contract, value-added tax invoice, export invoice, and return description of the goods to be returned. Generally it can be done within 3 days.

7. What should I do if the documents are not complete and I cannot follow the return import declaration?

In actual operation, there are often situations where there is no way to provide a complete set of original export customs declaration documents (such as paying for export?), or the company has already gone through the tax refund procedures and does not want (or inconvenient) to pay tax, and cannot declare according to the returned import . So how to declare imports?

In this situation, companies usually choose general trade imports, that is, import the goods directly from abroad, provide a full set of customs declaration documents required for general trade imports, and pay import duties and value-added tax normally...

Note: There is no need to pay import duties and value-added tax for the import declaration of returned goods. Under the three prerequisites, you can strive to declare in accordance with the method of return. In addition, most port customs only accept the approval of return shipments for quality problems, so if you want to declare in accordance with the returned imports, please confirm with the customs broker in advance whether it can provide a full set of relevant customs declaration documents.

Please enter keyword search