At present, the old mechanical and electrical equipment imported from abroad in China mainly include: second-hand machine tools (processing center/grinding machine/punch/milling machine, etc.), second-hand textile equipment (rapier loom/knitting machine/comb machine/automatic winder, etc.), Second-hand instruments (mass spectrometer/chromatograph, etc.), second-hand production lines (filling production line/packaging production line/testing production line, etc.), second-hand printing presses, second-hand forklifts, second-hand agricultural equipment (cotton pickers/harvesting machines), second-hand molds (injection Mold/foam mold/die-casting mold, etc.) and second-hand placement machine, second-hand injection molding machine and other equipment.

General process: foreign shipment to Hong Kong → Hong Kong exchange order → delivery to our company's Hong Kong inspection warehouse → processing used mechanical and electrical import inspection (appointment inspection / inspection / inspection certificate) → application for automatic import license (needed If it is) → Arrange for barge booking from Hong Kong to the domestic terminal → deliver the goods from the Hong Kong warehouse to the barge terminal → barge → goods to the domestic port → shipping company exchange order → import inspection → export customs clearance form (or commodity inspection transfer order) → Import declaration (customs price review/tax payment/tax payment) → inspection → customs release → pick up and deliver to the customer's designated warehouse.

1. Confirm the customs code Hscode

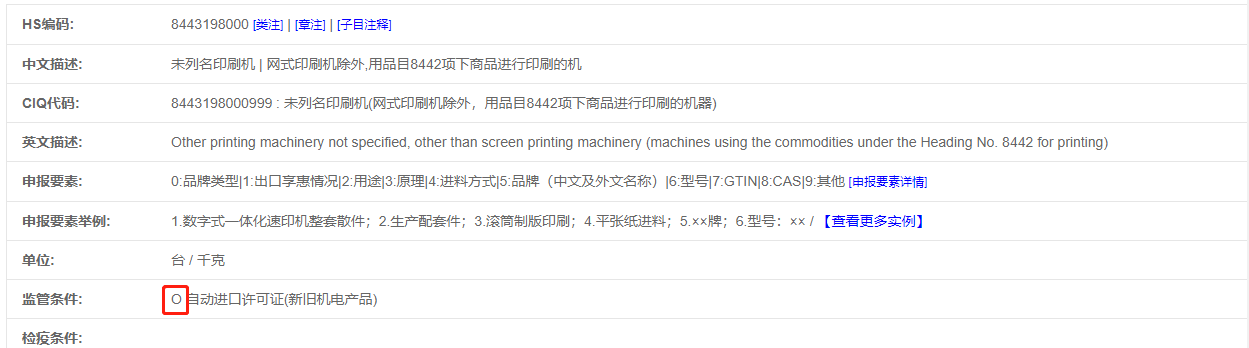

1. As long as the customs code is checked, it can be confirmed for all issues involving import documents, import tax rates, etc. The supervision conditions involved in the import of old mechanical and electrical equipment are: A: statutory commodity inspection (so the default for old mechanical and electrical products is legal inspection); 6: the import of old mechanical and electrical equipment is prohibited; O: automatic import license.

2. As long as the supervision condition corresponding to the customs code has "6", any old equipment is not allowed to be imported. If there is an "O", it is necessary to apply for an automatic import license in advance before customs declaration (two types of import licenses for ordinary used electromechanicals approved by the provincial bureau and key used electromechanical import licenses approved by the Beijing Ministry of Commerce). In addition, the import tax rates for different old equipment are different. For details, please refer to the "China Customs Declaration Practical Manual" published by China Customs Press every year.

The automatic import license of mechanical and electrical products is usually displayed as "O" in the column of customs supervision conditions, so it is commonly called "O certificate" or mechanical and electrical certificate.

The automatic import licenses for dairy products, olive oil, iron ore and other products are usually displayed as "7" in the column of customs supervision conditions. The automatic import licenses for these products are usually called "7 certificates".

2. Quickly check whether imported mechanical and electrical products need to apply for automatic import license

To check whether you need to apply for an O certificate, the first step is to confirm the accurate customs code (if you don’t know how to check the customs code, you can apply for pre-classification of the customs code); then pass the "Customs Import and Export Tariff of the People's Republic of China" ( Commonly known as the code book) Find the "Supervision Conditions" column corresponding to the customs code, and see if there is an "O". An "O" means that both new and old mechanical and electrical products need to apply for an automatic import license. If there is a "6", it means "The import of old mechanical and electrical products is prohibited". Simply put, it means that old equipment with regulatory requirements 6 is not allowed to be imported (such as some old medical equipment CT machines, etc.).

When importing old mechanical and electrical products, there is a very special situation. The supervision conditions clearly do not show an "O", but the customs requires us to provide an automatic import license. This situation usually occurs in the “key old mechanical and electrical products” mentioned above.

What are the key old mechanical and electrical products? Key old mechanical and electrical products refer to old mechanical and electrical products that involve national security, social public interest, human health or safety, animal and plant life or health, and pollute the environment. The state implements import restrictions on key used mechanical and electrical products. (The automatic import license for key used mechanical and electrical products is an automatic import license for the import of key used mechanical and electrical products, referred to as "key used"). In principle, the import license for key old mechanical and electrical products can only be applied for by the factory for its own use, or companies with relevant equipment leasing and maintenance qualifications.

The key old mechanical and electrical products mainly include: old chemical equipment (rectification equipment, etc.), old engineering equipment (excavators, etc.), old papermaking equipment, old printing equipment, old food processing equipment, old metal smelting equipment, old electrical and power equipment, old Agricultural equipment (milking machine, etc.)

3.confirm the operation plan

This link is mainly to compile a complete set of operation plans by concluding information such as the location of the machine, the final receiving place of the customer, and the actual situation of the machine.

For example, if the machine is in a foreign country, it is necessary to arrange a foreign door-to-door pick-up, and then ship it to Hong Kong for mid-inspection (that is, to apply for the inspection certificate of imported old mechanical and electrical products), then the plan must be made before the formal operation, and the goods will be sent to after the mid-inspection Which terminal declares imports etc. must be clearly confirmed.

4. Formal operation-intermediate inspection link (start with the arrival of the goods in Hong Kong-import declaration at the domestic destination port)

Overseas inspection: First fill in the application form to make an appointment for inspection. After receiving the application, the inspection company will reply to the inspection fee according to the quantity of equipment, the value of the goods and the location of the warehouse where the inspection is performed; pay the inspection fee in advance (including the inspection company Inspection fee and travel expenses, etc.); after the inspection company confirms receipt of the payment, it will communicate with the inspection contact person about the specific time for inspection; leave the factory for inspection and give rectification suggestions; inspection certificate (operation The time limit is about 5-7 working days), and then the export declaration link (expected 2-3 days).

Hong Kong Intermediate Inspection: After the foreign shipment arrives in Hong Kong, the bill of lading and the power of attorney and other documents go to the Hong Kong shipping company to exchange the order, settle the Hong Kong destination port fee (expected HKD2200/20GP, HKD3000/40GP), and then pick up the goods to our company Hong Kong warehouse. After the machine is put in the warehouse, we will make an appointment as soon as possible from the inspection company to send someone to do the inspection. If the machine needs to be cleaned or rectified, we will take care of it before the inspection. Normal inspection takes half a day. -3 working days. When doing inspections, it is required to place the machine flat in an open place (mid-inspection site) in advance, unpack the package, and make sure that you can take pictures of the whole machine and the nameplate pictures. After the inspection certificate is issued, arrange booking for barges from Hong Kong to domestic ports, and then deliver the goods to the barge terminal designated by the barge company. The main costs involved in this link are: Hong Kong shipping company fees, pickup fees, Hong Kong warehouse loading and unloading fees, intermediate inspection site fees, storage fees, intermediate inspection fees, Hong Kong warehouse to barge terminal transportation fees, etc.

5. Import declaration link (normal 2-3 working days)

The goods arrive at the domestic port—>Go to the shipping company to change the bill and settle the shipping company’s destination port charges (THC/DOC, etc., for specific costs, please refer to the shipping company’s arrival notice)—>Import inspection—>Import clearance Order (or Commodity Inspection and Dismissal Order)—>Prepare the packing list, invoice, contract, bill of lading, declaration elements and other customs declaration information in advance. As long as the manifest information is found, the declaration can be sent to the customs. (Currently, the customs strictly grasps the efficiency of customs clearance. The goods can be pre-declared before arriving at the port)—>Customs price review/If the declared price is okay, basically the tax is paid on the same day—>tax payment—>Customs on-site inspection (wait for the system to notify whether to check)—>pass the inspection After the system is released—>arrange the terminal to handle the order, settle the terminal fee and other unpaid expenses—>arrange fumigation and disinfection, and pick up the container at the terminal—>deliver to the customer's designated warehouse.